Over the past several weeks we have been talking about car payments and how to avoid them. We’ve discussed the benefits of being without a car payment, the importance of keeping up with routine vehicle maintenance, and the real hurdle of preparing for the unexpected in terms of vehicle replacement. Now let’s talk about how to plan for a vehicle purchase in such a way that you are able to buy without remaining in a cycle of debt and car payments.

Budgeting

In our last post, we talked about the importance of vehicle maintenance in helping prolong the life of your vehicle. However, there are times where routine maintenance simply won’t matter. Major engine damage, theft, or accidents can happen at any time, and when they do, it can throw a wrench in your plans, and that assumes that you have a plan to begin with!

In continuation of our series on avoiding car payments, I wanted to talk about some of the important things we have had to keep in mind as vehicle owners, particularly when owning slightly older vehicles that we’ve bought with cash. In this part, we will talk about the importance of vehicle maintenance. If you missed the first part of our series, you can catch up here.

My wife and I abhor car payments. When we had been married just a little more than two years, we decided that we were financially sound enough to purchase a “new” vehicle. In this case that meant one that was already 3 years old, but it was certainly new to us!

I don’t know about you but there’s one place that a lot of my money is spent: the grocery store. Rich and I spend about $125.00 per week, (that’s about $500.00/month) sometimes a little more and sometimes a little less...

Have you ever looked in your wallet for the $20 you know you put in there only to discover that there are a few bills but they don’t add up to $20? Or maybe you’ve looked at the balance in your checking account to discover that there’s less there than you thought? Try as you might you just can’t recall what happened to that money! I know this happens in our house and I bet it has occurred in yours also.

The holidays are a dangerous time for budgets. We tend to throw them out the window in the spirit of gift giving. The result is that we mortgage our future well-being in order to buy gifts for others. That doesn’t make any sense at all, but it doesn’t stop us from doing it.

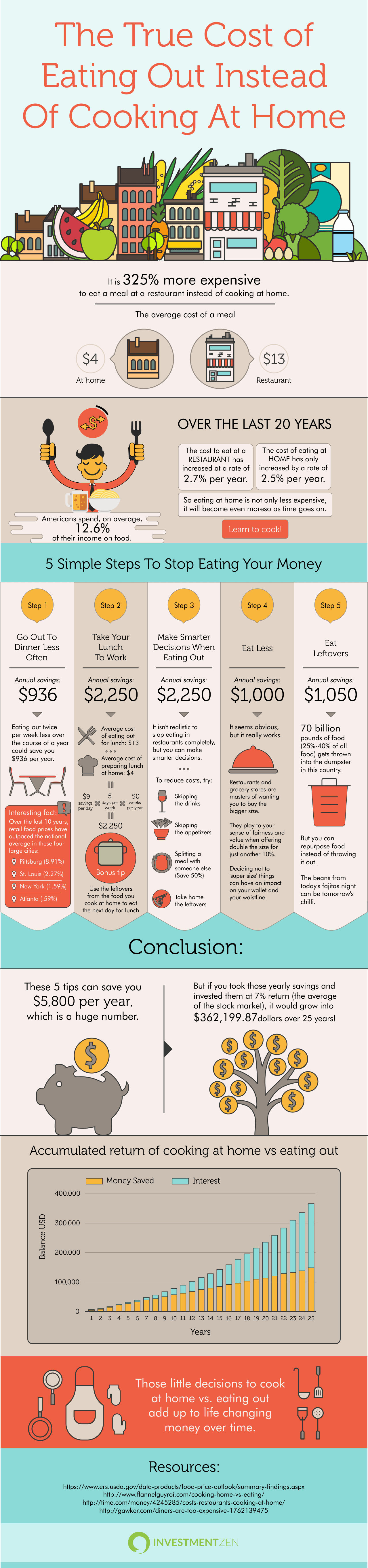

If you were to write down every single thing you spent for an entire month, there would be some things that would almost certainly surprise you. Hopefully, your rent or mortgage payment, your car payment, and any insurance or utility payments would not be among those surprises. One that might be, is just how much you spend each month eating out.

When we started the Money Coaches, we did so because we felt that providing financial coaching filled a very real need and that it could benefit just about anyone. The way we thought it could help the most was as an employee benefit. While we are happy to help individuals, our main focus has been on working with companies to do just that. Why?